PAY-AS-YOU-EARN AND PAYSLIP

PAY-AS-YOU-EARN

Pay-as-you-earn is a tax deducted from employee salary account and remitted on or before the 10th day of the month following the month in which salaries were paid. See relevant sections of the Personal Income Tax Act (PITA). (S.81 of Personal Income Tax Act Cap P8 LFN 2011). S. for details

WHAT IS TAXABLE ENTITLEMENT (GROSS) OR GROSS EMOLUMENTS

This is the total amount your employer pay to you as salary including all benefits arising from employment.

It can be a inform of wages, salaries, allowances including benefits in kind, gratuities, superannuation and any other incomes derived solely by reason of employment.

All manner of allowance you earn, provided it’s not a re-imbursement of expense to you, is taxable.

Finance Act 2020, defined “gross income” as income from all sources less non-taxable income, tax-exempt items listed in Paragraph (2) of the Sixth Schedule and all allowable business expenses and capital allowance (finance-act-2020). This is addition to the Act.

For example, if you spend an amount for training outside your station and the money is refunded or reimburse through your payslip, it must be subjected to tax. All pay not intended to be taxed must not be passed through payroll. Pay like training cost, transport to attend training etc.

TAX RELIEF (TAX ALLOWANCE)

This is amounts that can be deducted from a person’s annual income to reduce the amount on which tax is paid. Or the amount of your income which is exempt from tax aside from other statutory deductions.

- Consolidated relief allowance of N200, 000 or 1 per cent of gross salary or whichever is higher plus 20 per cent of gross salary.

- Percentage of Gross Income Relief (PGI): This relief is graduated and it is based on your Gross income. The higher your income, the more relief you receive. PGI relief is currently 20%. For example, if your Gross income per annum is

N5, 000,000 then your PGI would beN1, 000,000.

TAX EXEMPT

The tax law provides certain payroll deductions as tax exempt or non-taxable deductions. Tax exempt amount has to be removed from Gross taxable Income (earnings) before applying the tax rules to determine tax. The following deductions are not Taxable (.i.e. Tax Exempts):

- Pension Deductions (employer 10% and employee 8% of Basic salary, transport and housing allowance).

- National Housing Fund Deductions (Employee 2.5% of basic salary).

- Life Assurance Payments (this is obtained from the employee life policy document and monthly premium payment receipt is sufficient evidence to earn the tax exempt. Section 33(3) of Finance Act 2020 added that any premium payment. stated that there shall be allowed a deduction of annual amount of any premium paid by the individual during the year preceding the year of assessment to an insurance company in respect of insurance on his life or the life of his spouse or of a contract for a deferred annuity on his own life or the life of his spouse (finance-act-2020). This is addition to the Act.

- The National Health Insurance Scheme (Government 10% and employee 5% of basic salary) but employer 5% has not be implemented yet in the federal government MDAs due to Labour objections.

- Gratuity.

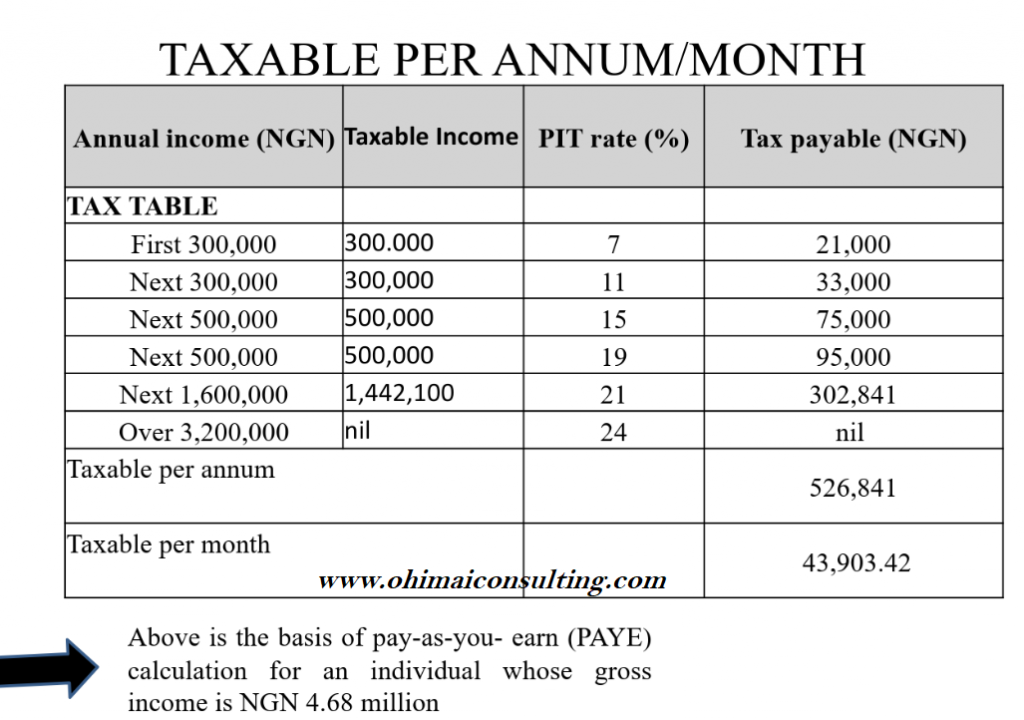

NIGERIA TAX TABLE

for pay-as-you-earn to be done, relief allowance and tax exemptions have been granted to work with, the balance of the income shall be taxed as specified in the tax table below.

Nigerian Payroll tax table comes in annual gross bands in six rows. Each band has a percentage tax value attached to it. The tax table rates must be applied to the Net Taxable Income to get Tax Payable.

Tax table and Rates from June 2011 tax year as see below.

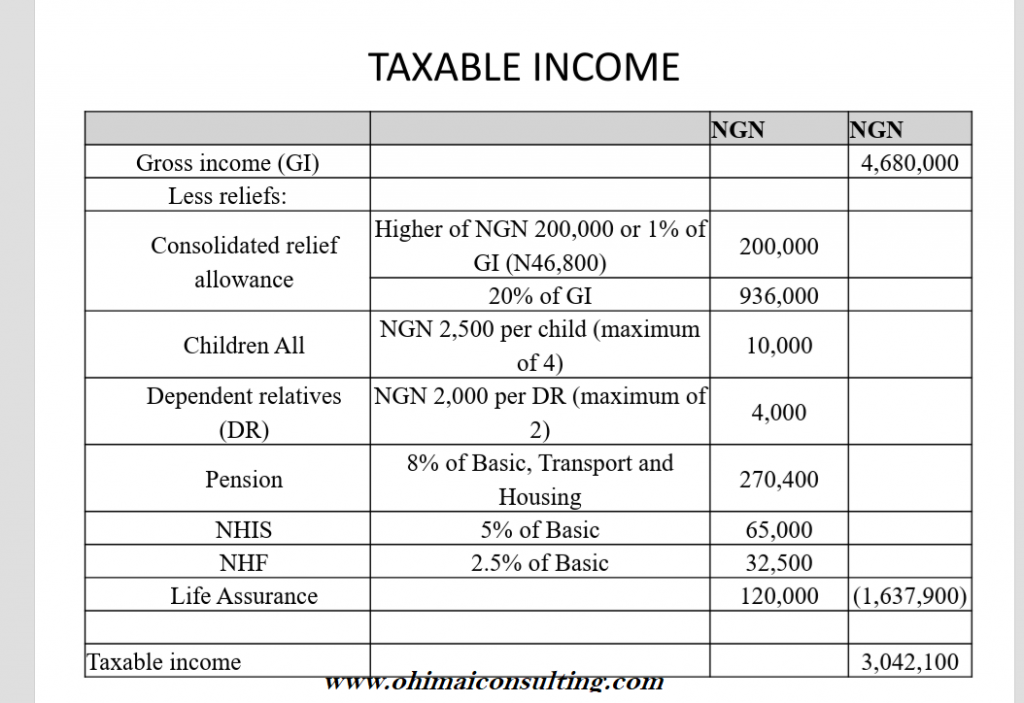

TAXABLE INCOME (NET)

This is derived after deducting the following from Gross Taxable Income. Some are extracted from payslip.

- Gross Entitlement,

- Tax Exempts, and Relief (Tax Allowance).

- Apply tax table to the net amount as stated above

NON TAXABLE INCOME

- End of year award

- Compensation for personal injury

- Any compensation for loss of office or employment

- Medical or dental expenses incurred by employee

Note:

Compensation for loss office or employment

(1) Section 36(2) of Finance Act 2020 is amended by substituting for subsection 2 with a new subsection “2”.

(2) Sums obtained by a way of compensation for loss of office, up to a maximum of N10,000,000, shall not be chargeable gains and subject to tax under the Act. Provided that any sum in excess of N10, 000,000 shall not be so exempted but the excess amount shall be chargeable gains and subject to tax accordingly.

Finance Act 2020 inserted section (3) and (4)

(3) Any person who pays compensation for the loss of office to individual is required, at the point of payment of such compensation, to deduct and remit the tax due under this section to the relevant tax authority.

(4) The tax so deducted shall be remitted within the time specified under the Pay-As-You-Earn regulations issued pursuant to the personal income tax Act.

PAY-AS-YOU-EARN CALCULATION

In other word, monthly payments of Pay-As-You-Earn (PAYE) tax liabilities are to be made on or before the 10th day of the month following the applicable month (e.g. January tax to be remitted by 10th of February).

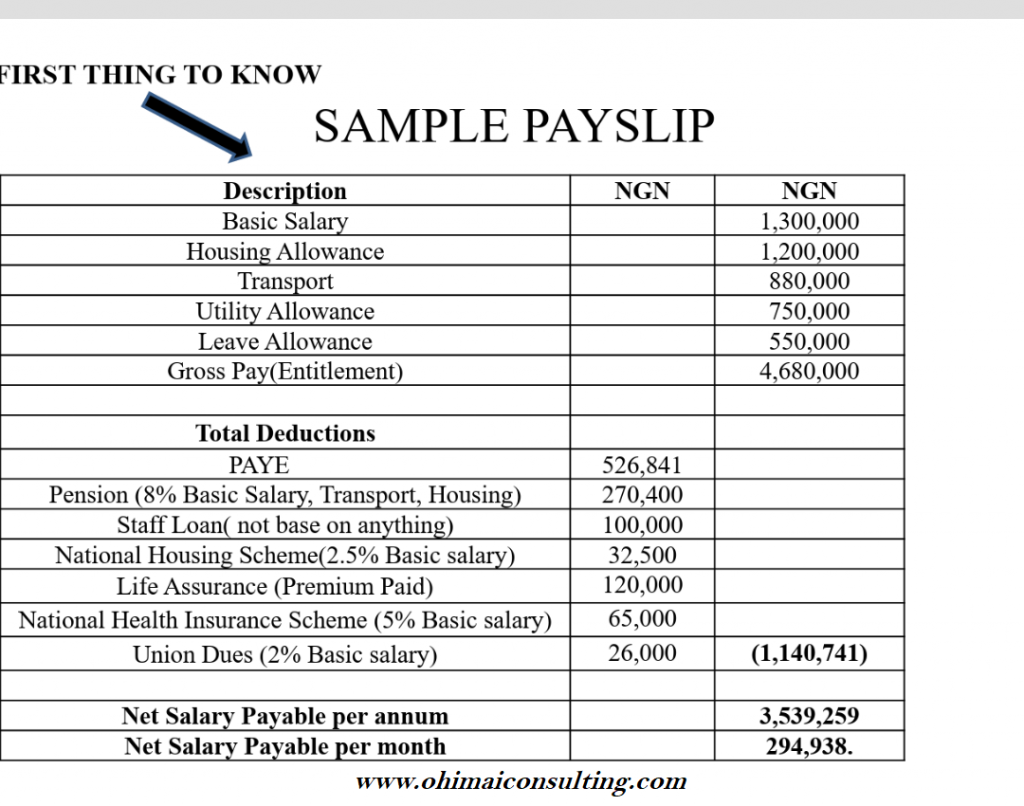

Assuming Senior Manager monthly payslip is as shown below. We look at how the statutory deductions were determined.

Taxable Income Calculation for an Senior Manager whose Gross Income is NGN 4.68 Million per annum

Below is the basis of Pay-as-you-earn calculation for a Senior Manager whose gross income is NGN 4.68 million per annum. The accountant has the responsibility to ensure that this PAYE is calculated accurately and deducted promptly

WHAT IS RESIDENCY RULE

Assuming the Senior Manager live in Rivers State but work in Abia State.

To apply residency rule, an employee’s PAYE is payable to the tax authority of the state of his/her residence. It is therefore the duty of the employer to deduct and remit it to the tax authority where the employee is resident.

If the employee is resident in Rivers State, the tax authority that is entitled to his pay-as-you-earn is the Rivers State Board of Internal Revenue.

PENALTY FOR FAILURE TO DEDUCT PAY-AS-YOU-EARN

In line with Section 74(1) of Personal Income Tax Act, 2011 states “ any person or body corporate who fails to deduct, or having deducted, fails to remit such deductions to the relevant tax authority within 30days. This will be from the date the amount was deducted or the time the duty to deduct arose. Such person shall be liable to a penalty of an amount of 10% of the tax not deducted or remitted in addition to the amount of tax not deducted or remitted plus interest at the prevailing monetary policy rate of Central Bank of Nigeria.

EXEMPTION OF MINIMUM WAGE EARNERS FROM PAYE/PIT

Section 37 of Finance Act 2020 “provided for minimum tax. The Act also provided for under the Sixth Schedule to this Act shall not apply to a person in any year of assessment where such person earns the National Minimum Wage or less from an employment (finance-act-2020)

BOOKS OF ACCOUNTS

By Section 12 of PITA 2011 stated that the keeping of books of accounts is very important. The Act stated that, if any taxable person fails or refuses to keep account, such a person shall be liable on conviction to a penalty of N50,000 for individuals and N500,000 for corporate entities.

Video:

How to calculate Staff Salary and Pay-As-You-Earn(PAYE) in Nigeria

SUMMARY

Ensure full compliance with the law. You can consult us for your professional services.

Friday Ojeaburu ACA, PhD