Purchase Order

Purchase Order

Purchase orders (PO) are essential for an accountant to help achieve financial goals and is one of the key Source Documents in Accounting. The buyer sends these orders to the vendor or sellers or suppliers, outlining what they expect for the order and when it should arrive. In contrast, a sales order generated by the supplier and sent to the buyer. Additionally, the supplier generates an invoice to show the buyer how much they owe for the purchased goods.

Benefits of Purchase Orders (PO)

- Controlling the procurement of products and services from external suppliers is easier with purchase order.

- The inventory process is more accessible with the help of PO. Once the supplier receives the PO, they will retrieve the items listed in the PO from their inventory.

- The Purchase Order acts as a legal document that helps prevent future transaction disputes.

- It prevent duplicate orders by keeping track of order and from whom, which can be challenging when a company decides to scale its business.

- Overall, a well-organized purchase order system helps simplify the inventory and shipping process by keeping track of incoming orders.

The process of initiating a purchase order should begin with:

When a buyer needs goods, they start by creating a purchase requisition. This document helps to keep track of the items ordered and is sent to the purchasing department within the company. It also helps the company keep track of expenses. The acountant can only create purchase order once an authorized manager has approved the purchase requisition.

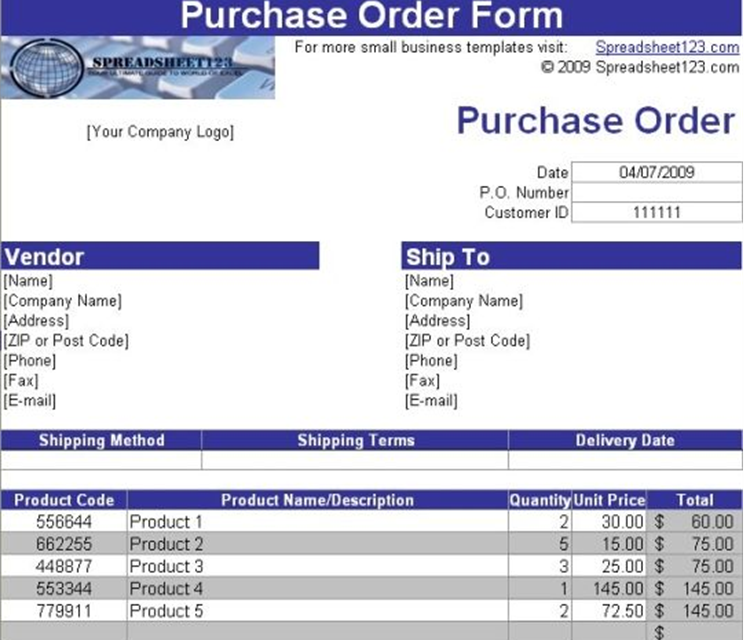

Once the buyer has confirmed the goods they wish to purchase, they will initiate a PO. This document will include the date of the order, FOB shipping information, discount terms, buyer and seller names, a description of the goods under process, item number, price, quantity, and the PO number as shown in the attachment.

The seller can accept or reject a PO with all the transaction and buyer’s requirements. If the seller agrees with the PO, it becomes a legally binding contract.

Keeping a record of the purchase order is crucial for buyers. The demand remains active until the company receive all or part of the goods.

Goods Receive Note (GRN) is issue after successful delivery from suppliers. Each order has an assigned unique number associated with the Purchase order number. The accountant can use this number to ensure that the goods received match those ordered and listed on the GRN.

Before company accountant make payment, they will verify that the Purchase order number matches the invoice. This ensures that the charges to pay by the buyer are the correct amount for the goods before processing the payment.