How accountant use drone technology

Introduction

How accountant use Drone technology to achieve their task depends on the sectors or schedule of activities. In addition, drones are unmanned aerial vehicles (UAVs) that can fly remotely.

The global drone market predicts to increase from $26.3 billion in 2021 to $41.3 billion by 2026. Also, in 2020, both US and the UK used drones to deliver drugs during the COVID-19 pandemic (Appelbaum et al., 2020).

Drone technology has proven helpful in war zones and intelligence gathering and also in a civilian role, such as:

- Accounting and Auditing Profession,

- Search And Rescue,

- Traffic Monitoring,

- Videography,

- Surveillance,

- Delivery Services,

- Weather Monitoring,

- Drone-Based Photography,

- Firefighting, Agriculture,

- Personal Use.

- Land surveying

These Countries use of Drone Technology

Countries that make use of drone technology and require permission for all aerial drones through regulation.

Moreover, the regulation addresses different types of civil drone operations and their respective levels of risk as stated by European Union Aviation Safety Agency

- In Germany, there are limited zones outside protected areas with high urban density or people conglomerations.

- Also, all EU Member States, including Norway and Liechtenstein.

- Switzerland and Iceland are also expected to apply this regulation soon.

- In United States for example, they used drone technology for their operation(Ovaska-Few, 2017).

- In 2013, Poland passed a law allowing the commercial operation of drones, which led to the birth of Drone Powered Solutions.

- South Africa that has entirely established drone regulations in place which was carefully integrated into existing aviation law.

- Lastly, in Australia, Rio Tinto who has its facility in a remote area planned in 2016 to start using drone to monitor mine sites including the staff.

Companies that have used drone in their workplace and in others area of operations.

- It was recorded that PwC completed its first stock count audit using drone technology. With the assistance of a drone, they were able to capture images at a coal reserve in South Wales and used them to measure the volume of the coal, based on the measurement of volume.

- Amazon and Google are already testing ways to deliver packages with drones.

- Facebook has started using drones to provide internet connections in remote locations.

- Basin Electric’s utilization of drones has enhanced efficiency and safety while concurrently reducing costs.

- Furthermore, Ford Motor Company filed a patent to start the use of drones for dead bateries. The patent was filed on 3rd February, 2017 and circulated on March 8th, 2022, and assigned serial number 11271420.

How Accountant Use Drone Technology to the Accounting Profession.

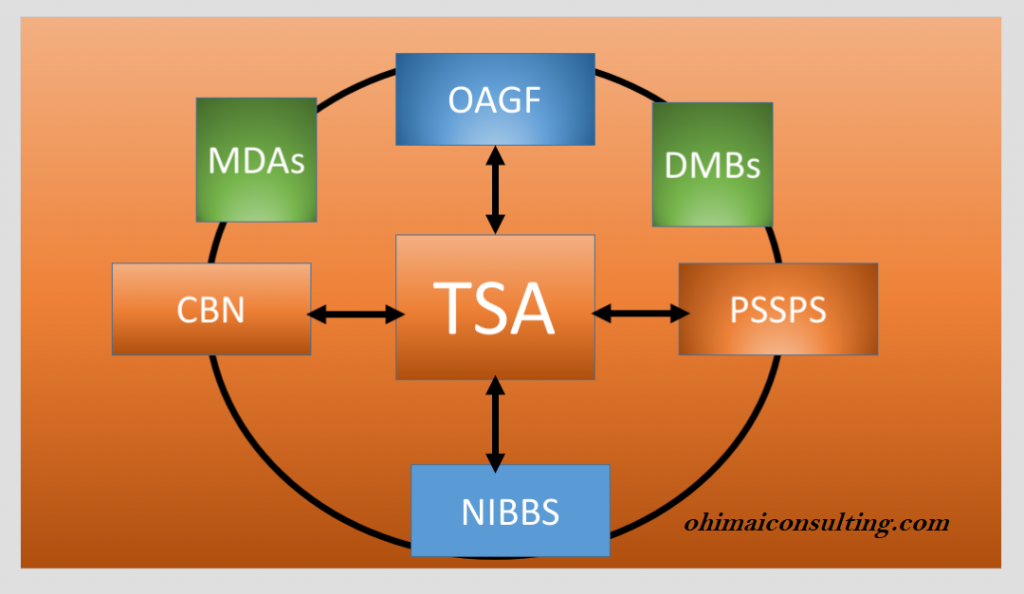

Source: Naira Technology

With the help of drone technology, however, accountants can now complete their work in a shorter amount of time. Technological advancements have significantly changed the accounting and auditing profession in recent years.

In 2017, the emergence of drone technology has revolutionized the accounting and auditing profession. Drones have opened up new possibilities for accountants to perform their tasks more efficiently and effectively.

Emerging technologies like AI, blockchain, big data, the IOT, and drone technology have revolutionized accounting profession (Qasim et al., 21).

For example, accounting and audit firms that work with clients in mining and inventory can utilize drone technology to take thousands of pictures and measurements of a site (Ovaska-Few,2017).

Also, this can aid in accurate assessments of holdings, making tasks like physically measuring coal a thing of the past. An estimated volume can be obtained in less time with just a two-meter GPS Tracking pole.

What are the Benefits of Drone Technology to the Accounting and Audit profession.

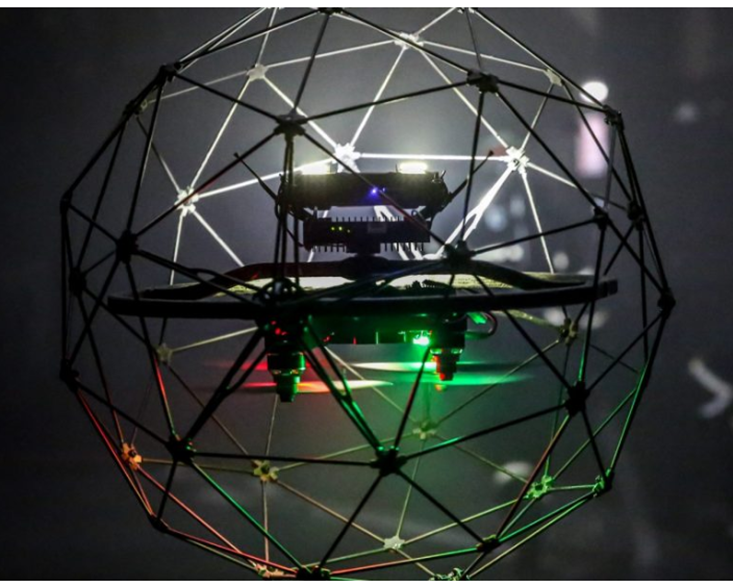

Source: djm-aerial.com

These list below are the 18 benefits of how accountant use drone in the accounting and auditing profession.

- Revenue Recognition

- Perform physical inventory: Drone could recount inventory if required-data feed repeatedly into audit app that re-performs the process. Using drones to automate livestock inventory count reduced count time from 681 hours to 19 hours (Qasim et al., 21).

- Asset valuation and Verification: Visually inspect the asset for impairment, safety is not an issue.

- Time-efficiency and effectiveness: Drone devices help to improve and increase effectiveness and efficiency in the accounting and auditing profession.

- Accuracy: Produce accurate data that can be relevant for future forecast and planning. It depend on how accountant use drone technology to collect insight into the condition of assets. This is faster, cheaper, safer and more accurate than traditional methods (Johnson, 2022).

- Save Cost: Drones may save money for accounting clients, who can use them for stock takes, mapping, safety monitoring and to inspect bridges and building.

- Productivity: It can enhance productivity

- Also, Reduce the risk of injury: he benefit in health and safety as the need for someone to climb over the coal pile are removed.

- Speed: Helps speed up some business and accounting processes.

- Monitoring strategies . Help monitor staff, operation and some dangerous zone. For instance, drones can assist the firm or staff to take account area difficult to reach.

- Storage of Long-term data: Moreover, drone methods allow for storage of long-term data. This is useful to account for physical factors (like weather, light conditions and geomorphology of the beach) for more spatio-temporal analysis.

- Automate and accelerate repetitive accounting tasks (Qasim et al., 21).

- High Quality Data Acquisition

- Enhance Mobility

- Reduce Downtime

- It improves disaster Recovery situation

- Enhance Trend Analysis: It depends on how accountant use drone technology to conduct trend analysis.

- Lastly, Enhance Maintenance Standards

The technology produces massive amounts of data that require interpretation and translation into meaningful information for informed business decisions.

Also, as accountants keeping up to date with new technologies and understanding their potential to enhance efficiency and effectiveness is essential. Developing the necessary skills to interpret and present data will enable them to add value to their employers. Since the drones technology are control by expert . However, drones are prone to making mistakes just like any other technology, which is why one can exempt them from errors.

Source: Rewires

Furthermore, competent accountants who are conversant with latest technology, play a crucial role in helping companies thrive and maintain a competitive advantage. It is imperative that organizations have skilled accountants on their team to achieve these goals.

Implications of How Accountant use drone Technology to the Accountants and Auditors

- Be part of the at least 95% that will accept this new technology if they must prepare for the future.

- Develop a new skill that is all-encompassing for them to be relevant every time and drive the development of accounting profession.

- For companies to successfully transform, there will be a great demand for individuals with fundamental knowledge and expertise. For instance, such individuals must possess the necessary skills and understanding to support the company’s transformational goals.

- Also, become a consultant in the field to remain relevant and being in change of the world where we live by data.

- Become a strategic thinker.

- Apply professional judgement whenever is necessary and obtain a better results

- Establish Drone-focused department that enable accounting firms to handle all matter related to drone.

- Check the impact of drones on client’s business operations.

- Lastly, it is vital for every accountant or auditors to be familiar with the present drone regulations in their countries.

Conclusion

In this article, the writer examined how accountant use drone technology and to achieve their work on daily basis. Similarly, drones can improve the accuracy and efficiency of audits. However, how they can use it to collect data and perform inspections in hard-to-reach areas.

Consequently, the article highlighted the potential impact of commercial drones on the accounting profession, with predictions that this technology will revolutionize traditional accounting procedures (Ovaska-Few, 2017). Accounting professionals and academics need to recognize the significance of drone technology and patronize the suppliers as it is here to stay. In addion, the sooner we adapt to this technology and use it to their advantage, the better. Accountants and auditors are condition to embrace this new technology and see it as an improvement to their jobs instead of threat.

Order Now: Book Shop