Cooperative Accounting

Cooperative accounting is the applications of financial accounting principles, concepts and policies to cooperatives in order to ascertain its financial position, promote accountability, efficient management and ensure viable operations of co-operative financial resources.

In other words, the accounting system and bookkeeper accurately record and report the cooperative’s daily business transactions.

Furthermore, the cooperative law makes the keeping of proper sets of accounting records and the preparation of the final accounts compulsory for every registered cooperative society and sets of information that must be disclosed in the final account.

Moreover, the cash books and receipts are source documents, while income and expenditure accounts and balance sheets are final accounts.

ACCOUNTS AND RECORDS OF COOPERATIVE ACCOUNTING.

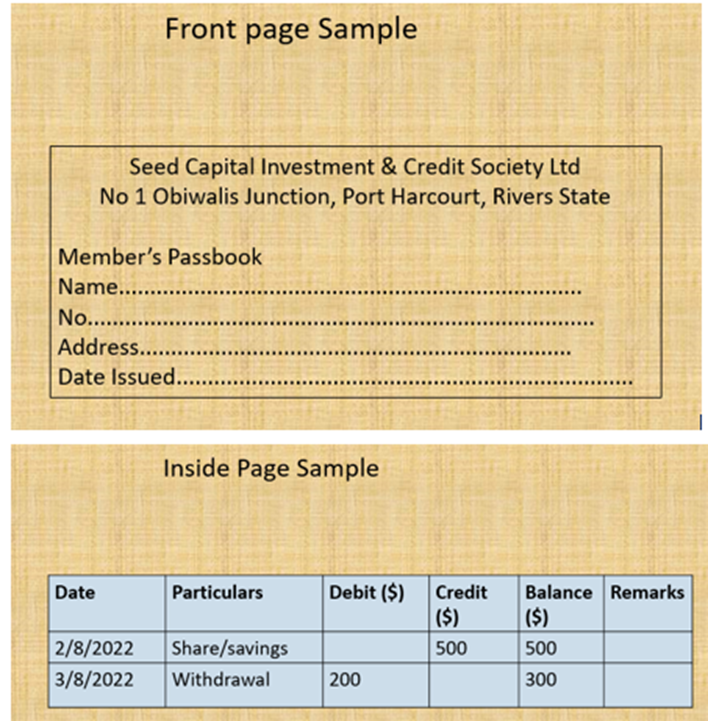

1.MEMBER’S PASSBOOK

Member’s passbook is opened for every member which serves as a personal account on which all transactions between a member and the society are recorded. Moreover, below is the front- and back-page sample of members passbook.

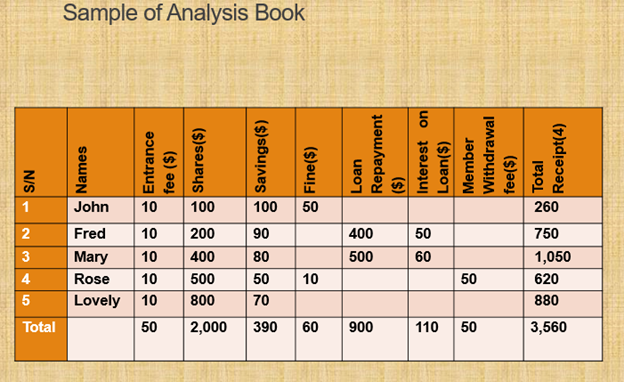

2. ANALYSIS BOOK

Also, analysis book is use for recording members’ contributions, loan disbursed and repayment, membership withdrawal, fine and other incomes on monthly basis. However, this book helps to analyse the transaction on a monthly basis. In addition, this book help cooperative to always spread open in front of members at any general meeting of the society.

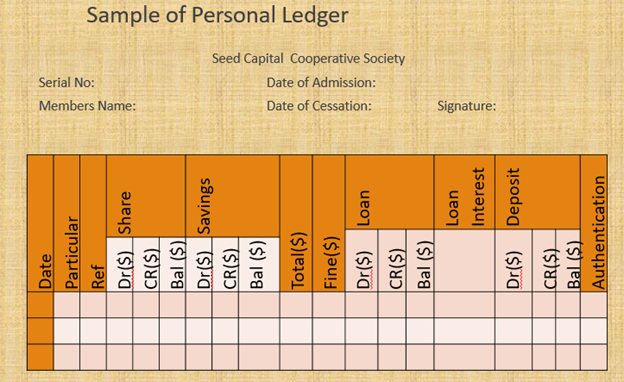

3. PERSONAL LEDGER

Personal ledger helps to record member’s contributions of shares, savings, deposits, withdrawals, loan and refunds. In addition, the entries into this book are from the individual’s entries in the analysis book which is also entered in the passbook. With proper recording of transaction, individual cash balances can be seen at a glance.

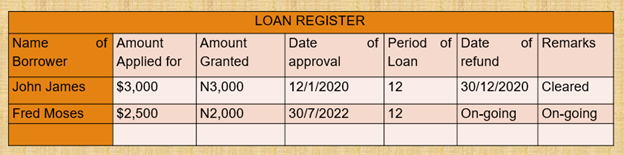

4. LOAN REGISTER

Obviously, Loan register is a source document containing information regarding all loans granted at any time. In addition, such information includes membership personal number; member identity number; committee meeting minute number; cheque number. Also, includes amount authorized and approved; amount applied for and granted; date of approval and refund; period of the loan.

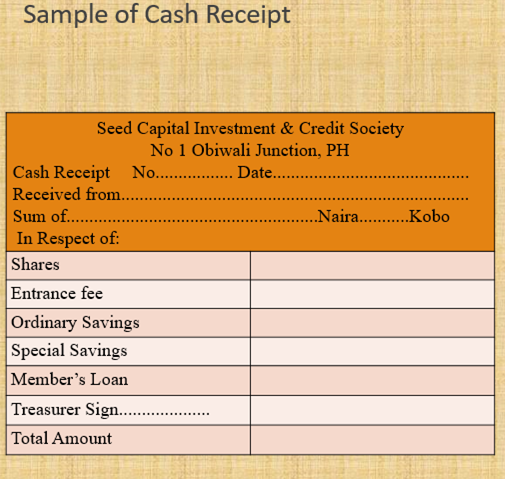

5. CASH RECEIPT

Also, cash receipt helps to record all money received in cash or in cheque. Also, it is financial transactions used as supporting evidence that money have been received on behalf of the society. Moreover, all receipts must be serially numbered and used in that order.

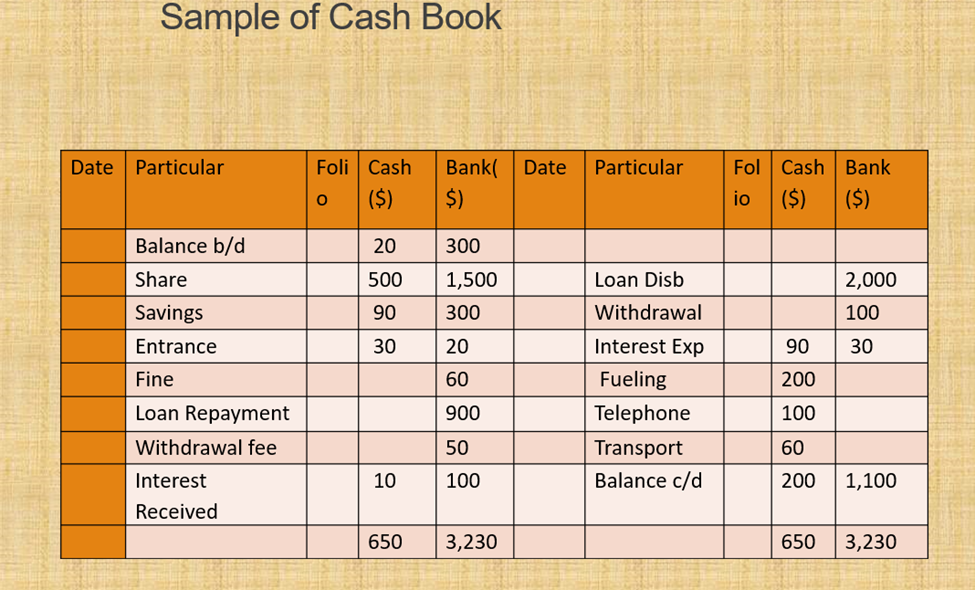

6. CASH BOOK

Moreover, a cash book is a financial record that shows all cash receipts and disbursements, including bank deposits, withdrawals, and balances.

7. INDIVIDUAL MEMBERS’ CONTRIBUTION

Additionally, in co-operative management, recording all transactions and producing financial statements on time is important. Clearly, these statements are the output based on each member’s contributions. By tabulating each member’s share and savings contributions in the individual contribution table, it’s easy to see the breakdown of each member’s contributions. Column A shows the fraction of each member’s share contribution, while column B shows their savings contribution.

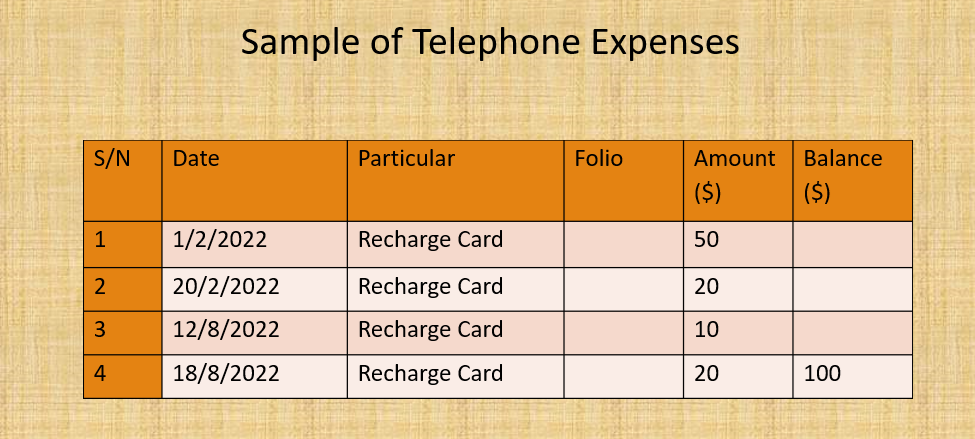

8. GENERAL LEDGER

A general ledger is a cooperative financial record-keeping system that uses debit and credit account records. It can validate a trial balance, such as bank charges, telephone, and travelling expenses and asset account.

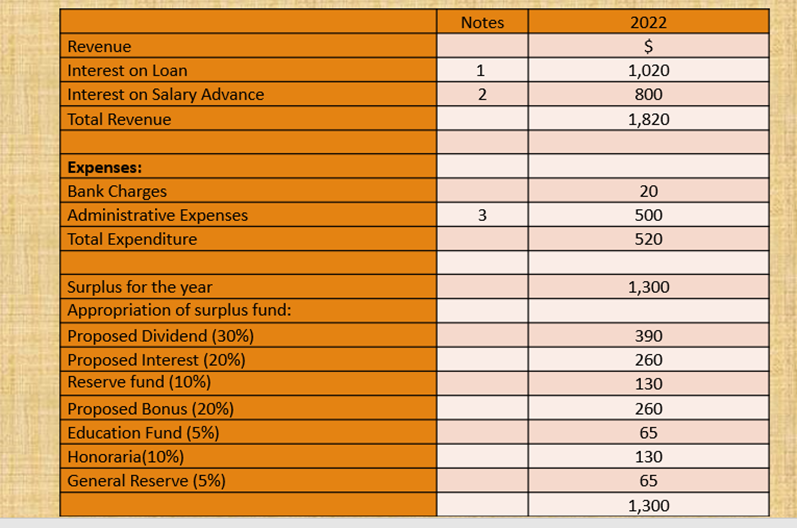

9. INCOME AND EXPENDITURE ACCOUNT

The Income and Expenditure Account summarises all the income and expenses incurred during the current accounting year. Its primary objective is to calculate the surplus or deficit. However, cooperatives only declare surplus or deficit, not profit or loss, since they are exempt from paying taxes.

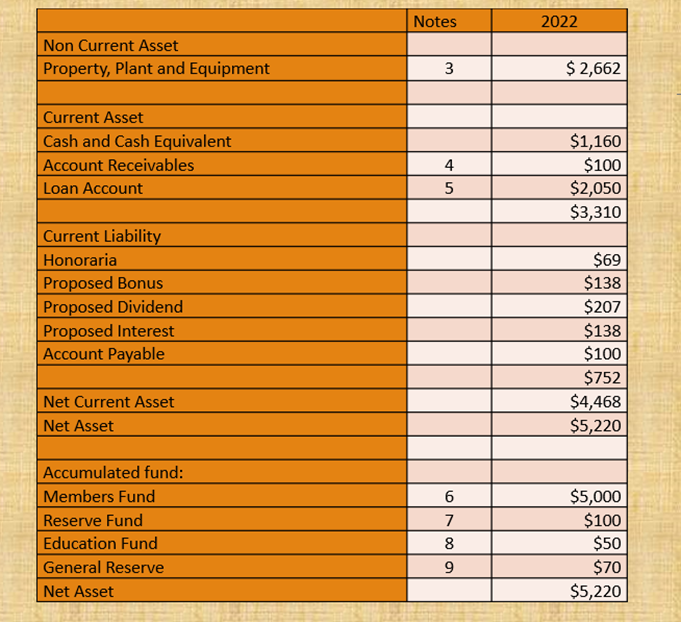

10. STATEMENT OF FINANCIAL POSITION

A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity on a specific date. It summarises the business’s overall value at a particular time, like a snapshot.

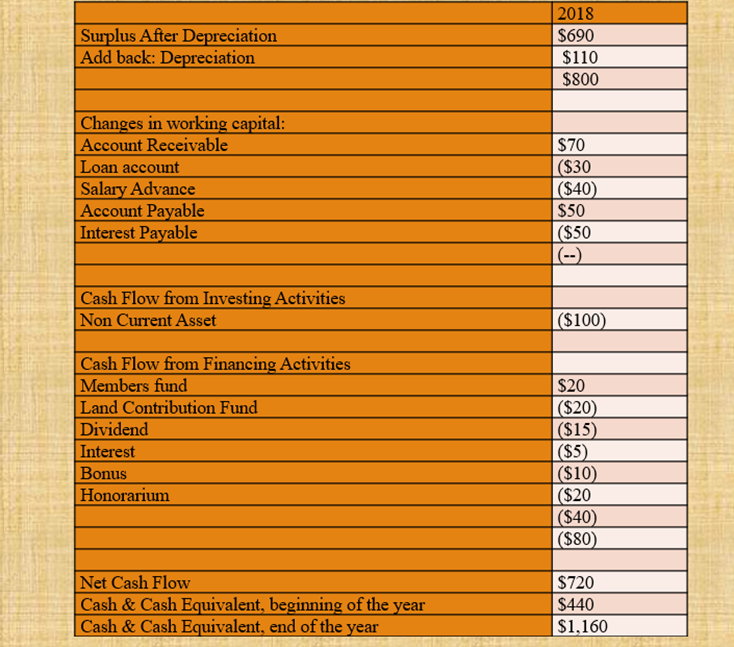

11. CASH FLOW STATEMENT

In addition, a cash flow statement is a financial record that presents a company’s incoming and outgoing cash for a specific period. This document shows the cash flows, the money that comes in and goes out of the business. Cooperative uses these statements to keep track of, document, monitor, and report these transactions.

CONCLUSION

Therefore, cooperative laws around the world require the maintenance of proper accounting records. However, seeking assistance from experts with practical experience can help improve your cooperative accounting system. Furthermore, if you are looking for the best way to manage a cooperative society, consider purchasing a revised cooperative book from our book-shop or at Amazon.com.

Download free Excel financial model designed for cooperative accounting management.

If you are facing any issues related to the financial model, please feel free to contact me for consultancy services.