Treasury Single Account

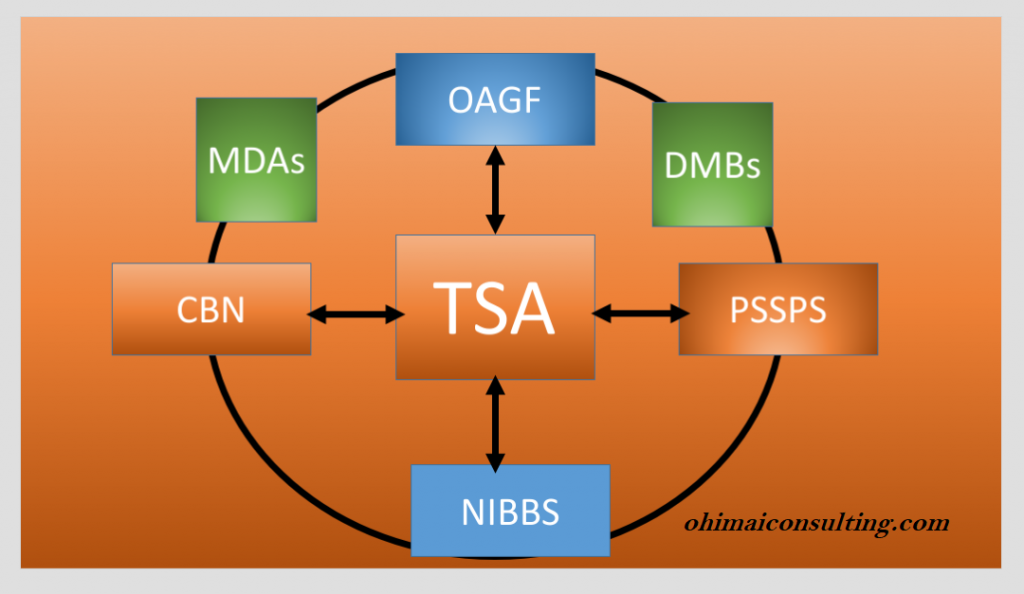

Treasury Single Account (TSA): This is defined as a unified structure of government bank accounts for MDA’s. TSA is a single account in the custody of the Central Bank of Nigeria (CBN). TSA is a bank account or a set of linked accounts through which the government transacts all its receipts and payments. Treasury Single Account is a concluding phase of the E-collection scheme. The Federal Government of Nigeria commenced the implementation of e-collection component of TSA in January 2015. The first Treasury Circular on e-Collection was issued on the 19th of March 2015.

E-collection automates and streamline revenues and other monies payable to MDAs as well as other Institutions and Parastatal directly into the Consolidated Revenue Fund (CRF) or designated accounts of each MDA at CBN using the CBN Payment Gateway.

This is one of the good initiatives of federal government of Nigeria that has help to bring about transparency and accountability. This initiative has given Nigeria government control over the management of fund in the hand of Ministries, Department and Agencies (MDAs).

OBJECTIVES OF FGN E-COLLECTION

- Ensure total compliance with the relevant provisions of the 1999 Constitution of the Federal Republic of Nigeria (FRN) (Section 162 & 80).

- Collect and remit all revenues due to the Federation Account and Federal Government Consolidated Revenue Fund.

- Block all leakages in government revenue generation, collection and remittance

- Enthrone a new regime of transparency and accountability in the management of government receipts.

- Improve on availability of funds for development programs and projects.

- Align with the CBN Cashless policy.

- Ease the burden of revenue payers.

BENEFITS OF TSA

- Government have oversight of all revenue and other monies collected by MDAs

2. Increase Government receipt by blocking any form of leakages

3. Makes it easier for Nigerians to pay government through introduction of electronic channels like Cards, Internet Banking and POS.

4. Payment is received promptly, and service can be rendered to the payer

5. Ensure availability of funds for the execution of government policies, programmes and projects. Control aggregate cash flows within fiscal and monetary limits

6. Improve management of domestic borrowing programme

7. Investment of idle funds

8. Improves transparency and accountability of all FGN receipts

9. Consolidated view of government cash position and status

TREASURY SINGLE ACCOUNT STAKEHOLDERS

- Ministries, Departments & Agencies (MDAs);

2. Deposit Money Banks (DMBs);

3. Central Bank of Nigeria (CBN);

4. Service Providers.

THE ROLE OF CBN IN TSA

- Provide payment gateway platform

2. Development of overall e-collection and e-payment policies for the nation

3. Interfacing with Deposit Money Banks (DMBs) and monitoring them

4. Creation and maintenance of bank accounts including CRF/TSA, FAAC and TSA Sub Accounts

THE ROLE OF DEPOSIT MONEY BANKS (DMB)

Ensures that:

- Their duties under the subsisting Payment Gateway MOU are effectively discharged

2. Customers making payment to government are given prompt service

3. All collections in favour of government are promptly remitted

4. Operational and other relevant issues are logged with appropriate authorities (OAGF, CBN and REMITA) without delay

The ROLE OF MDAs

- Ensure that their revenue targets are met

2. Provide their payers with details of payment including amount and nature of payment

3. Guide payers on e-collection processes including how to pay at the bank or through other channels of the CBN Payment Gateway (Remita).

4. Where applicable, ensure that appropriate services are rendered upon confirmation of payment

THE ROLE OF OFFICE OF THE ACCOUNTANT-GENERAL OF THE FEDERATION (OAGF)

- Ensure effective implementation of e-collection

2. Development of operational guidelines

3. Proper monitoring of the collection gateway

4. Prompt reconciliation of all collections

5. Support MDAs, banks and payers for smooth operation of e-collection

6. Regular monitoring of all collections to ensure that they are promptly remitted and accounted for

7. Issuance as well as continuous review and update of the e-Collection guidelines and processes

8. Abide by the provisions of the Memorandum of Understanding (MOU) with CBN, Service Provider and Banks

THE ROLE OF SERVICE PROVIDER ie Remitta, Interswtich etc

- Work with CBN, OAGF and other stakeholders to articulate system requirements

2. Provide a robust, stable and effective integrated processing platform

3. Ensure the optimal availability of all relevant systems and platforms

4. Provide effective and efficient support to users of the platform

5. Provide users with relevant reports

6. Training of users on the use of the payment gateway.

E-PAYMENT

This is an electronic system of payment for all of government funds through the banks either commercial banks or CBN. The Federal Government of Nigeria commenced the implementation of Treasury Single Account (TSA) in April 2012, with the e-Payment component. E-payment covers the following transactions:

All payments to

- contracts and consultants.

2. service providers e.g. PHCN.

3. payment to staff.

4. payment to other government agencies e.g. National Health Insurance Scheme (NHIS), Federal Inland Revenue Service (FIRS), National Housing Fund (NHF).

Issuance as well as continuous review and update of the e-Collection guidelines and processes

BENEFITS OF E-PAYMENT

These are some of the E-Payment benefits:

It eliminates the:

1. Unacceptable delay in payments

2. The uses of cheques in payment of all transactions within the Federation Government

3. Interaction between the contractor and government official in the payment of FG contracts

4. Ghost workers

For more information on Treasury Single Account, buy my book on

JOB INTERVIEW MADE EASY FOR PUBLIC SECTOR Dr Friday Ojeaburu

Contact Us – Ohimaiconsulting.Com

References

FGN MDA Categorization for FGN TSA/e-Collection

Ogbonna, G,N & Ojeaburu, F (2015). The Impact of Government Integrated Financial Management Information System (GIFMIS) on Economic Development of Nigeria. West African Journal of Business and Management Sciences, 4(1). 313-336. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3363159.

cite reference

Ojeaburu, F.(2021). Treasury Single Account. https://ohimaiconsulting.com/treasury-single-account/.